Our Services

IPO Advisory

Initial Public Offering (IPO) is one of the most important steps in the life and growth of a company. This milestone signifies a transition of an organization from the private to public domain.

Some of the key considerations for a company to embark on an IPO include:

Raising cash

Increasing profile and reputation

Achieving alignment of interests

Gaining transaction currency and tax benefit

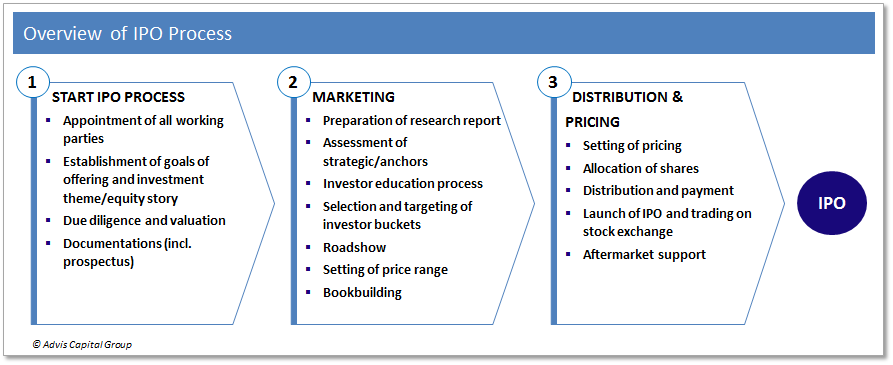

Our experience and observation are that many companies may naively enter an IPO journey without properly understanding the process and various implications. There are multitude of parties to coordinate with, and myriad of topics, considerations, tasks, and potential issues to manage. We help to navigate and defend client's interest throughout the IPO process.

The value-adds we contribute come from real world experience in assisting companies in public market domestic and international issuance. We have unique strength for having worked previously at the side of the underwriting investment banks. As such, we possess first-hand knowledge and insights on what would be a bad and good process. From preparation, selecting the truly suitable counter-parties to work with (underwriters, legal counsels, etc.), and pitching stage to valuation and book building.

Being an independent adviser and free of conflict of interest, we work alongside clients and help in ensuring that the IPO process is performed to the best interest of the company and its shareholders.